Why low interest rates drove startup madness

I wanted to share my perspective on why so many tech companies are laying off employees. This won't be comprehensive and only represents my views, so I also welcome feedback and other perspective. I also wanted to get this out over the holidays so it won't be a polished piece.

Tech companies are laying off employees. Layoffs.fyi shows 1,000 companies laid off ~152,000 people in 2022.

Fundraising has become more difficult. According to Tribe Capital (A Record Shortage of Venture Capital - Tribe Capital), there 1/3 of the capital that will be asked for at Series B, for example. Cooley also released their venture trends Trends | Cooley GO showing a major reduction in financing at Series A and beyond.

Summary

Low interest rates made venture capital a much more attractive asset class, funneling more money into VC and by consequence startups.

Two consequences:

Investors valued startups based on higher revenue multiples. With more venture dollars, financings were also more competitive so investors pre-empted rounds ahead of round specific de-risking milestones. This put further pressure on the true limiting factor to growth, which is talent, sending talent to the wrong companies while also increasing salaries.

Startups were being rewarded for growth with very high revenue multiples. Every initiative and new hire could meet the hurdle rate, instead of just the very best projects and hires, resulting in suboptimal use of capital. Startups most aggressively growing could raise follow-on capital, often within months, at higher valuations.

With rates rising, projects and hires that were justified no longer meet the hurdle rate, leading to cancelled projects and layoffs.

What should you do?

Reset mentally. Treat capital as extremely precious. Rank order every product and revenue investment and focus on those directly tied to PMF or most likely to accelerate new revenue, retain customers, or drive revenue expansion. Read Everything is a DCF by Michael Mauboussin

The expected Reward in Risk vs. Reward is set by the Fed

The economy is largely influenced by monetary policy, which is the setting of interest rates by the US Federal Reserve. This is the rate banks can borrow from the US government and is considered 'risk-free' because of the low risk of the US government defaulting on its debts. We borrow money to invest in projects that create economic growth. The higher interest rates, the higher the bar a given project must meet to justify an investment.

Here is the historical data for the 10 year risk-free rate. The reason I'm showing the 10 year treasure for the purposes of the risk-free rate is because when investing in a startup (or venture fund), a typical time horizon would be 10 years. If you were investing in a project with a shorter (or longer) time horizon, you would use a different risk-free rate.

In 1980 for example, you could get 16% by buying and holding US 10 Year Treasuries. Think about that for a moment...when the long-term average of the S&P500 is 7-8% per year.

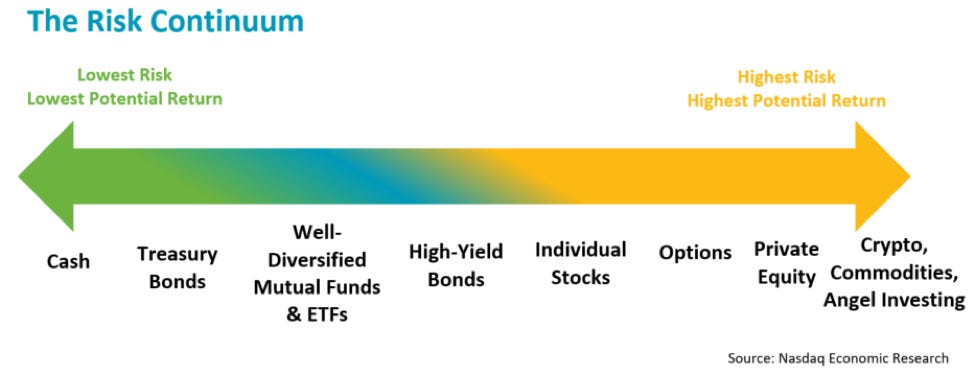

Investors compare other investment opportunity to this risk-free rate. There is a continuum of investment opportunities that are riskier. Risker investments must offer investors a higher return than lower risk alternatives to justify the risk. Note that the returns are *not* guaranteed. You can (and many do) lose their money in riskier asset classes.

On the continuum, debt is risker than treasuries, public equities are riskier than debt, and illiquid early stage startups are riskier still. The yield is calculated as that cash payment over the price of the bond and must represent a premium over the Treasury rate available to investors. So even after a company issues a bond, if interest rates rise, the yield of a bond must also go up to make the additional risk worthwhile. The market solves this by reducing the price of the bond (yield increases as fixed interest payment over a less expensive bond).

This same principle explains why many people believe 'real estate only goes up in value'. It doesn't. Real estate acts like a bond and the 30 year mortgage rate has been consistently declining since 1982. As rates increase we should see real estate prices come down.

Diving into the VC / Startup Asset Class

Startups are one of the riskiest asset classes because many fail. Some create successful products, but do not become profitable businesses, and some become profitable businesses but don't distribute cash back to investors via M&A or IPO. Furthermore, startups are non-liquid, meaning you might have to wait 5-15 years for an opportunity to sell the shares. These factors contribute to investors’ expecting, but not being guaranteed!, a much higher return over the risk-free rate.

Many VCs would be thrilled to return 3x after fees over 10 years to their LPs (limited partners, the investors in their funds - typically pension funds, endowments, high or ultra-high net worth individuals). This works out to ~4x before fees, or about 15% per year for 10 years. This is very hard to do. If the fund has raised $250M, it means creating $1.25B in value across 10-15 investments, where many will go to zero. Companies can only create liquidity in 4 ways:

Paying dividends, which few venture backed startups do because it is hard to become profitable and most profits are reinvested into growth and R&D.

Being acquired. Typically a strategic acquirer, although we're seeing increasing examples of private equity firms like Vista, Carlyle Group, etc. buying high cash-flow yielding technology companies.

Going public. Typically requires over $100M in revenue and the potential for long-term profitable growth.

Secondary share sale. Finding an investor to take the shares off your hands.

When venture capital returns 15% per year and the risk-free rate is 2%, more investors are going to invest in VC. But imagine what fundraising for VC would have looked like in 1980 when treasure yields were 16% and an investor could have gotten higher returns (16% vs. 15%) via buying treasuries.

Low interest rates --> VC asset class returns very enticing --> More investor money flows into VC

High interest rates --> VC asset class less enticing --> Less investor money flows into VC

One point that I'm ignoring is whether or not venture returns themselves increase in low interest rate environments - I don't have a defensible position on this because the returns are often captured 5-10 years after LP capital is committed, so I don't believe LPs consider this too strongly in their decision to invest.

Because most venture funds deploy funds within 3 years, there is a lag between the LP commitment and when VC dollars get deployed. You can see why January 2020 was a great time to raise a venture fund, and that in the 3 years afterwards there were record deployments.

The 2nd and 3rd order effects of too much Venture Capital

Bad allocation of financial capital led to bad allocation of human capital. I won't dwell on this, but I believe venture capital is a noble calling and capital allocation to risky, innovative businesses is critical to society. There was method to providing capital and advice to the riskiest, highest potential impact companies in increasing chunks as the entrepreneurs de-risked key parts of the technology and business. We saw some investors investing huge dollars into startups before those risk reducing proof points existed, meaning the true limiting factor to growth, talented people, went to companies that are unlikely to succeed. It will still take 2-3 years for the cash and talent to flow out of those companies into the ones that will make an impact.

Within startups, extremely high revenue multiples and preemptive funding rounds led to an extreme focus on growth at all costs. In sales, for example, the historical rule of thumb was that an Account Executive should deliver 4-5x their fully loaded cost in revenue to meet the hurdle rate. So an AE costing $200,000 a year should deliver $800,000 to $1,000,000 in ARR. In the world of 0% interest rates, even an AE that only delivered $250,000 a year, a 'poor' ROI, would add $5M or more ($250,000 times 20+) to the startups valuation. Ten such hires would add $50M+ to a startups valuation in 12 months. This wasn't real, long-term, value creation. I worked with many excellent revenue teams during these years and everybody was laser focused on making new sellers extremely successful, I'm just highlighting the perverse incentives for uncomfortably high growth and hiring. Charlie Munger is reported to have said "Show me the incentive, I'll show you the outcome."

Things to consider in 2023

Reset any prior expectations around growth rates, team size, valuation and dilution and understand what investors will look for in a future round. One triangulating point is to ask yourself what ARR you will need to achieve at a 10x revenue multiple to your last round’s valuation. Then assume you will need to allocate $1.5-2.0M of capital for sales and marketing to add $1M of ARR, with a goal of getting to $1.33 in S&M cost to add $1 of ARR (i.e., Magic Number of 0.75). Pressure test with a reasonable Burn Multiple.

https://a16z.com/growth/guide-growth-metrics and David Sacks’ Substack are great sources.Treat capital as extremely precious. Rank order every product and revenue investment and focus on those directly tied to PMF or most likely to accelerate new revenue, retain customers, or drive revenue expansion. Think of your company as a black box that must efficiently convert precious cash into business outcomes. Imagine that you will only get credit for the business outcomes and metrics investors will see in 12 months. What will you stop spending on? Review your team. People join startups for many reasons and I wouldn't be surprised if many people joined startups in the last years that are not truly suited to the risk, pressure and expectations. Many leaders were also enticed by the ability to quickly scale large teams versus creating capital efficient machines. Ensure everyone is on the same page that efficiency is what is in. If you are pre-PMF, my advice is that your rate of building cannot exceed your rate of learning. If you build faster than you learn, you are introducing yield loss and are unnecessarily burning capital. You will also move faster with a smaller team.